GENEVA & NEW YORK

|

| The leader, the follower

and the laggard |

I have been asked for a while to share my system-evaluation and -implementation experience with the community and my readership by comparing the three most frequently shortlisted cloud HR systems: SAP (SuccessFactors), Oracle (Fusion) and Workday. I will from now on refer to them as SOW, to be pronounced either to rhyme with "low" (as in "low adoption") or to sound like a female pig since some of these vendors' features are no better than lipstick on a pig. *

Of apples and oranges

Although there are more than three cloud-based HR vendors, the reason I am limiting myself to the SOW usual suspects is because they are the only ones with a global reach to meet the complex requirements of multinational companies. Despite attempts to the contrary,

Ultimate is still a US vendor,

Meta4 has all but disappeared,

HR Access has been folded into Sopra and

Cornerstone has yet to make up its mind whether to develop a full-fledged HR Admin module - and without an HR system of record you cannot have a global HRIS worth its salt.

ADP is mainly a payroll outsourcer with multiple products (some in the cloud and covering various HR processes) but not a global HR system of record.

Infor has yet to rationalize its product offering

à la Fusion and its Lawson offering was never a truly global HRIS. And some of these vendors' "cloud" offerings are really nothing more than a quick repackaging of their old hosting business. So, here we are, stuck with SOW.

This being said, it is worth remembering that to a large extent we are comparing apples and oranges since there are such key differences between these vendors that some evaluation exercises can turn to the surreal.

Oracle, for instance, is mainly a database vendor with a strong anti-cloud history and a PeopleSoft legacy customer base which has yet to endorse Oracle Fusion.

SAP, which comes from the application world, has therefore more serious credentials, reinforced by its continuing investment in the SuccessFactors platform. Its main issue is that, in addition to some questionable product decisions, it has yet to articulate a cogent cloud-based ERP strategy. This is the main reason why I refer to Oracle and SAP (along with some others) as dinosaurs in a

popular blog post. Workday, on the other hand, is of course a native cloud vendor which has quickly shot to the top of the league table with an offering, business culture and service quality that the other dinosaurs can only dream of emulating. Yet, Workday is far from perfect and also has some serious issues.

SaaS and cloud

Some companies may not care about the differences between SaaS and cloud, some may even be ignorant of them, but it is good to remind my readership of the meaning of these two concepts which are often and wrongly used interchangeably. SaaS is the most advanced form of the cloud where all parts of an offering (hardware, database, software) come from a single vendor. All you the customer need to provide is a browser-toting device (desktop/tablet/smartphone) and you're in business. Workday is thus a true SaaS vendor. SuccessFactors, whose offering relies on some on-premise legacy features which are hosted, is getting there but cannot be considered 100% SaaS. As for Oracle, who first developed its Fusion product as an on-premise solution, and can deliver it as a hosted system, it is therefore in the cloud but of course not SaaS. So remember this key differentiator: A

ll SaaS systems are by definition cloud-based, but the reverse is not true.

Stats wars

As the community knows, I have zero tolerance for fanciful figures, especially around customer numbers. Some of the fairy tales I hear are so absurd that I am unsure whether to laugh or sob when I hear them. The below scorecards provide a reasonable count of LIVE customers as per each cloud system. If the customer is still on PeopleSoft for HR Admin and has interfaced it to Taleo or some Fusion talent modules, Oracle will refer to this misleadingly as Cloud HCM. I don't. Same thing for SAP: If Employee Central is not implemented, then I do not count SuccessFactors as a reference - it is only a talent project, not a global HR one. Workday is easier since, by definition, their system cannot run without core HR as a foundation (although some customers use a light HR version to start with talent processes such as performance.)

Integrated/interfaced/unified/organic etc.

After phony customer count figures, the biggest source of BS that comes from vendors has to do with how well integrated the offering is. Here misinformation is rife, with

Oracle the undisputed leader. Fusion, which can come in different flavors as mentioned earlier (public cloud, private cloud, on-premise - see below) does not necessarily cover all HR processes and most customers prefer to hang on to the legacy core HR. Talent features can come from either Fusion or Taleo. And within Taleo remember that the Learn.com product was built on .NET technology whereas Taleo was built on Java.

SAP SuccessFactors at least developed Employee Central on its own technology stack; however Plateau was not a 100% SaaS offering, and Concur and Fieldglass are based on other technologies. The other SF modules are also on different technologies which means a customer running the whole suite will have different code bases AND versions. (And as for Multiposting, well, nobody knows when/if it will be integrated in SF/EC.) Not pretty, and not full SaaS. And, of course, Employee Central Payroll is anything but an

Employee Central payroll.

Workday, on the other hand, as befits a product developed from scratch and organically, has the cleanest data model with all HR processes now available, except Learning. Payroll is largely work in progress, with the last two countries released (UK, France) yet to go live with a customer. I still have my doubts as to the ability of a single global SaaS payroll vendor to deliver the goods in an efficient manner.

I can already hear some jump and say, "Hold on a second. Workday, too, has integrated third-party technologies after acquiring Cape Clear and Identified." Most true, but there is a fundamental difference when you integrate a third-party product as part of your underlying technology and when you do it to cover a specific HR domain. With the latter you find yourself with a different look and feel, different workflows, a different data model. Any HR user who had to struggle with different products would tell you what a nightmare it is.

|

| 3 -VENDOR ANALYSIS: COMPANY COMPARISON |

Oracle Fusion has come a long way from an on-premise, complex-to-implement, functionally limited product with an ugly look and feel (those overloaded screens with horrid blue!), to one that can be deployed in the cloud. To get a sense of Fusion's background, refer to my post

"Error 404: Oracle Fusion not found".) Since then, it has made progress (especially on the UI front when it moved from FusionFX to Skyros), but its two other competitors, both cloud natives, have moved faster and often better. Oracle still

misses many key HR domains (see the product scorecard below) and its vision and roadmap at best are fuzzy, at worse don't make any sense: Why waste its time developing unneeded products such as Employee Wellness, Reputation Management, My Volunteering or low-priority ones such as HR Help Desk, and still miss, Tier-1 country localizations or Recruitment on the Fusion platform? The co-existence or hybrid approach is not a meaningful differentiator, but actually a sign of weakness: Missing key bits, Oracle tends to lump everything together and it's up to the customer to make sense of what is what and how to integrate it, not an easy task when Oracle is still

not very forthcoming when it comes to its offering, as explained below

.

Public Cloud, Private Cloud, and Cloud ServicesThe

Taleo product line is a case in point: Officially rebranded as Oracle Talent Cloud (but on their website still referred to as

Oracle Taleo Cloud) it is supposed to be the Recruiting offering to be interfaced to Fusion Core HR. However, the overlap issues (Fusion Performance vs Taleo Performance, say, or Fusion Compensation vs Taleo Compensation) has yet to be resolved. Ask the question and you'll get a mumble from poor sales executives who are none the wiser. Note that

Taleo is a hodgepodge of various acquisitions itself: Learn.com (with its scaling issues), Jobpartners, Recruitforce and Vurv, and Wordwide Compensation. (Not to mention that there are two Taleo flavors that go by the Enterprise and Business monikers)Talking about Compensation I find it a pity that Fusion does not allow user-defined logic to go into compensation elements, for instance to add a regional rate to a pay rate and calculate an employee's compensation on that basis.

Fusion, born as an on-premise product, can be hosted in a private cloud (customer's own environment) or shared (public cloud) with different deployment implications.

As if the (con)Fusion was not enough, you have

PeopleSoft Cloud Service which is as far from a SaaS offering as St Petersburg, Florida is from St Petersburg, Russia.

Then there is a host of other products such as

Right Now Policy Automation (benefit eligibility), another acquisition, which Oracle throws at befuddled customers.

Making sense of Oracle's offering is clearly not for the faint-hearted.

Great products are built by great people. The converse is also true: Mediocre people build mediocre products. Oracle, with its stifling bureaucracy and awful management, has

problems attracting and retaining quality people, especially in the HCM ¨product line. Add to that the fact that in Oracle's highly political culture the technology side has always had the upper hand versus product, and that HCM has always been the Cinderella application, only getting attention when a top leader emerges (first PeopleSoft, and now Workday.) This explains why the company never features in Great Places To Work league tables and has suffered from a steady hemorrhage of its best and brightest from PeopleSoft who have been poached from Workday, leaving a lot of deadwood behind.

An even bigger biggest issue with Oracle is how it

(mis)treats its long-suffering customers. Just this week, an old customer, the French Civil Aviation Authority, who has had enough of Oracle's abusive licensing and audit practices, decided to discontinue the use of all Oracle products. Last year, two other French companies, Carrefour and AFPA, went to court over the same issues and won. In 2014, a survey by the Campaign for Clear Licensing of 100 global Oracle customers found that 92% of them were deeply unhappy with the vendor. In the US, none other than the federal government decided in 2012 to ban Oracle from bidding for its business due to the vendor's questionable sales practices. Well, you get the idea. Unless you evince a particularly strong masochistic streak, selecting Oracle often means tough times ahead.

On the

technology front, Fusion, contrary to the vendor's spin, is not a "fusion" of its portfolio applications, but neither is it exclusively based on its unpopular EBS product line even if it borrows many features from it such as FastFormulas and Flexfields - the latter permeates Fusion even more than with EBS thus allowing good customization possibilities. However, Forms have mercifully been retired in favor of more modern Java and SOA-based technology. Outbound integration is a big headache as is data migration, even from Oracle's legacy systems. It is noteworthy that if many Oracle customers prefer to implement Fusion in the cloud rather than on-premise it is (in addition to the natural preference for the cloud), because, first, the HR Admin part has yet to reach functional parity with PeopleSoft (or Workday) and, second, the technical complexity of doing so is not to be ignored (just the sizing requirements would discourage the best-intentioned customer.)

Although initial

pricing can be quite seductive (Oracle heavily discounts Fusion in order to drive up customer adoption, or offers a credit to swap on-premise applications for cloud-based Fusion), the vendor's customer-relations record, as mentioned earlier, is far from reassuring. Also, if you are an-on premise customer and are renewing/extending your license, Oracle will throw a cloud subscription at you included in the package. You might as well take it, even if you are unsure whether you'll actually move to the cloud.

In summary, customers who already run an Oracle HR application (PeopleSoft, EBS, JDE), have a good rapport with the vendor (admittedly a rare occurrence), negotiate a financially interesting migration, do not need cutting-edge technology or terrific look and feel, and don't mind not being pampered or the complex integration behind products that come from disparate technological stacks, can look at Fusion seriously, especially when taking into account a strong point: its reversibility. Surprising as it may sound, there are still companies out there that are wary of the cloud (after the NSA snooping scandal and the current legal tug-of-war between US authorities and Apple and Microsoft you can't really blame them): With Oracle you can bring your HR system within your corporate firewall without having to switch systems and go through another complex implementation. This advantage comes at a hefty price, though: no single code line for all customers since, depending on what flavor of Fusion customers have, they can stay on their version much longer than public cloud customers. There are therefore multiple versions of Fusion at any given time, which increases the cost of running the product. And, as we all know, the customer always ends up bearing the costs. And if you are a customer who is still on the old look and feel, moving to the new one is not a straightforward process.

The world's largest business-software vendor, and the one with the most localized payrolls, took a leaf from its nemesis Oracle when it went down the acquisition road by acquiring SuccessFactors (SF). However, as I explained in detail in my

blog post on their strategy just after the transaction was announced, SAP differs markedly from Oracle: Rather than build from scratch a product for the cloud, in which neither had any experience, SAP decided to continue investing in the SF platform by beefing up its Core HR/HR Admin product a.k.a. Employee Central (EC). Although the latter has grown significantly since its earlier releases, it has yet to catch up to the group's leader, Workday.

One increasingly important strong point of SF is that it belongs to a European vendor. With all the

data-privacy issues raised by NSA snooping, many companies (especially European ones) are loath to go with a US-based vendor with a loss-of-data Sword of Damocles hanging over them.

Three weaknesses from SAP SF have yet to be solved:

-SF is

still missing a payroll module based on its own platform, and the misleading Employee Central Payroll (in reality a hosted SAP Payroll) is no substitute for a truly integrated offering. SAP brought us the largest number of localized payrolls on earth; Why can't it use that expertise to enhance SF and make it a truly global and comprehensive HR offering?

No full-fledged global HR system has come to market without its own payroll, so the jury is still out on whether SAP can be the exception that proves the rule.

- The

multiple code lines and releases that make up the SF platform need to converge on a single code line and release based on EC. It is bad product design and worse customer support not to inform a customer that they are not enjoying a critical feature because they are on a older release as happens with many customers. (Workday would never allow that to happen if only because the window customers have to move from one release to another is expressed in weeks, not months or years as is the case with SAP or Oracle.)

- SAP is also the vendor that brought us the integrated ERP. But it seems that all the strongly vaunted advantages of a single-platform ERP got lost in the move from on-premise to the cloud. All the HANA'ing in the world cannot hide the fact that the

company that gave us the on-premise integrated business software is incapable of pulling the same trick in the brave new world of the cloud.

In

a recent blog I compared

SF's and Workday's pricing so no need for me to repeat myself since that analysis is recent and therefore up to date. Oracle's talent-retaining issues are not unknown to SAP (I covered it in my recently updated blog post "

Could the last executive leaving SAP turn the lights off, please?")

Another issue SAP needs to fix is the

implementation methodology. SF came with its own methodology, SAP had another one, and integration partners are at times unaware of which is which. This will hardly help in building confidence in the offering. And the implementation template that SF provides does not list implementation activities in detail so you are often on your own. (Compare that with the fastidiously detailed documents you get from Workday)

Noteworthy is SAP's equivalent to Oracle's co-existence deployment model called here the

Talent Hybrid model. The two approaches are not much to write home about since customers have been doing it for a while: Integrating their on-premise HR system of record with cloud-based talent features. Actually, customers started doing it even before SAP and SF found themselves under the same roof.

Who is the most likely customer for SF as a global HRIS? Experience shows that it is mainly SAP's on-premise customers who move to the cloud with it, especially if they are already using SF for their talent needs (in particular Performance or Learning.) However, an increasing number of SAP's on-premise customers include Workday in their cloud evaluation, and a worryingly lengthening list have decided to go with it.

SAP, as a vendor, and SF, as a product, need to make themselves more attractive to retain these fickle customers.

|

| 3 -VENDOR ANALYSIS: PRODUCT COMPARISON |

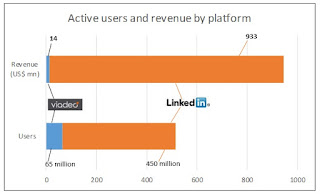

The HR thought leader and Wall Street darling has revolutionized the HR technology world (that search-based navigation was truly something out of this world when it first came out) and has just passed $1 billion in revenue (in comparison, Oracle's cloud HR business makes up less than 1% of its total revenue.)

Workday also has more customers using it as a cloud-based HR system of record than Oracle and SAP put together. They say that plagiarism is the best form of flattery; considering how many features of Fusion and SuccessFactors were obviously copied from Workday who premiered them, the newest kid on the block still retains its thought leader's crown.

What is attracting the crowds is a native-cloud product, built with consumer-grade usability, a depth of functionality that only those who built PeopleSoft could engineer, a customer focus and engagement that is still unique in the industry. The latter has made the vendor evolve its approach significantly: For instance, from the four releases a year at the beginning to a more manageable two now. Workday has also listened to customers and forsaken its rigidly neutral system-integrator (SI) approach: it will now recommend a specific SI for a specific project, something that was anathema for so long.

All the oohing and aahing about Workday, most of it well deserved, cannot hide that not everything is hunky-dory in the Pleasanton, CA-based HRIS heaven. You can read my

Open Letter to Workday's founders for a discussion of these issues. There are still some surprising holes to plug in the offering such as the production of contracts and offer letters or some workflow limitations (despite the fact that their workflow framework is the best of the three.) So far,

Payroll has been limited to North America and no date has been set for the release of the

Learning piece. The talent features have been improved significantly, in no small measure through the addition of a Recruitment module (some integration issues with their Core HR need to be fixed), but Workday has yet to reach functional parity with SuccessFactors in the talent space.

Reporting is undoubtedly one of Workday's strongest suits. For those who use PeopleSoft, it is such a relief not to need to be a PeopleTools expert to write Workday reports. To a large extent you can even say that Workday is a collection of reports since wherever you are in the system you can pull up the relevant reports many of which are "actionable" to use the hackneyed word. But, careful, user-friendliness here is more for the HR team, not occasional users, and it may be better to restrict the creation of reports to a core reporting team rather than jeopardize consistency by having any/everybody duplicating existing reports.

Customization, or lack thereof, is the hallmark of SaaS systems. Unfortunately, in the real world companies need a certain amount of customization which will not be lost when upgrading. Squaring the circle, you may think. Workday's custom objects is a move in the right direction, but it has its limitations: There are only so many custom objects you can have, you cannot use them where you see fit and cannot pull them up necessarily where needed. SuccessFactors, with its Metadata Framework-based extensibility approach (especially in Employee Central), does a better job in that respect and so does Oracle (with Flexfields, as mentioned earlier), as befits a product that is available both on-premise and in the cloud.

Workday's greatest success has probably been that

a significant segment of their customers comes from companies that either

had a Tier-2 vendor or did not have a single, global HR system of record (they

used various payrolls and different talent tools.) When these customers finally get their

act together, they tend to look at Workday first, rarely at SAP or

Oracle. However, cloud-seeking SAP and Oracle customers will almost always evaluate

Workday, even if they don’t systematically select it: that does not bode well

for the dinosaurs’ cloud future.

|

| 3 -VENDOR ANALYSIS: TECHNOLOGY COMPARISON |

|

NOTE ON SCORECARD METHODOLOGY

The grading is based on the many RFPs I have worked on and demos I have attended, along with my own knowledge of these products (derived in no small part from my own use of the systems) and feedback from customers other than the ones I have worked for.

The analysis has been done based on three sets of criteria: Vendor, Product and underlying Technology. Where awarding a grade does not make sense (such as pricing: expensive does not in and of itself mean bad, since often quality comes at a premium) I have left the relevant cells colorless. An explanation of most of the grades can be found throughout this blog post, but I have also mentioned them in the scorecards so that the reader can understand why a vendor is getting a YELLOW rather than an AMBER, for instance.

NOTE ON SOURCES AND COPYRIGHT

All data and graphs are by Ahmed Limam who is hereby asserting his copyright. They can be referred to with proper copyright and authorship acknowledgement.

*Some of the ideas in this post were first presented in an article I wrote for TechTarget in January 2015.

(In addition to the vendor-specific posts I mention throughout this piece, there are many more I wrote in the past few years focusing on a vendor or a particular issue. The most popular ones can be found in the list provided in the top-right corner and automatically updated based on viewer number. For other posts, you'll have to scroll down and search for them one by one).