PARIS

Anyone implementing Workday, either its HR offering (Workday HCM) or the Financials suite, will inevitably come across the compensation bit. And that's when challenges start and questions fly. What is involved? How easy is it to implement? How good are the products?

Having implemented Workday for the past 11 years for an exact number of 11 companies (talk of some symmetry!), here are a few tips on how to go about all things Compensation , organized along four pillars.

I. CORE COMPENSATION

It is a safe bet that if you're thinking about implementing Workday, chances are that you will be implementing Workday HCM and starting with the foundation product Core HR. Another safe bet is that as you plan on implementing all data, processes, security and reports involved with hiring, moving, promoting and terminating employees you'll have to implement the basics of Compensation. That is a foregone conclusion since no employee record is complete without at least some compensation components: salary and allowances that are committed to the employee when they are hired and onboarded.

With this module you can track all types of gross compensation (for net compensation, see Payroll below) usually set up via Compensation Plans. Those plans determine if an employee gets a monthly salary, some 13th- or 14th-month pay, some seniority, housing or transportation allowance or a one-time payment (for instance, a welcome bonus or severance payment.)

To decide how these plans are assigned to an employee Workday provides Eligibility Rules which can be fiendishly complex - if that's what you want. There's beauty in simplicity, so before you start making highly sophisticated rules to decide who gets what (belonging to company X, with a management level of Director but not part of Location Z etc.) do yourself a favor and think about the cost to the maintenance team. One thing I strongly advise against: Do not add employee ID in these eligibility rules. It's akin to making a law for just one citizen.

How thorough should your compensation be in Workday? It really depends on what your objectives are and how integrated your HRIS is. Some companies only track base salary and leave the rest in local systems. Others decide to have a full-fledged compensation system in Workday as a reflection of their rewards policy: In which case you'll have all types of Compensation Plans (not only Salary but Period plans, Allowances, One-time Payments) including, for the more complex ones, Calculated Plans. This way, especially for global companies, your compensation policies can migrate from local payroll systems (often the only HR system of record for those local subsidiaries) and become part and parcel of you global system. What is then left in Payroll is discussed in the next section.

II. WORKDAY PAYROLL

To help make a decision on what to keep in local payrolls and what is best handled in Workday, I have developed an analysis which I first shared with United Nations agencies when they started implementing Workday (In my distant past I worked 5 years for the UN: 2 in New York and 3 in Madrid.) Below is the framework I developed and then fine-tune for every customer. Since it is my intellectual property and proprietary analytical tool, contact me directly if you are interested.

I developed this multi-criteria analysis based on different combinations of criteria depending on company size, geography, scope, industry and management complexity. Although in its simplest expression payroll deals with gross-to-net calculation, the challenge is to reach agreement on what gross items needs to be part of the global Workday system and which ones can safely be left in local systems. I have spent an inordinate number of workshop hours with various companies trying to reconcile different stakeholders' positions on this topic. Note that some companies for some cases use net data in Workday Compensation (not Payroll) using a feature called Eligible Earnings Override.

Adding to the challenge is that some subsidiaries of multinationals may be willing to move to Workday Payroll while others would rather stick (for the time being, at least) to their current vendor. Even more challenging is the case, which I was recently involved with, where a global company had the US subsidiary already using Workday. It was quite complex to convince them that they had to re-implement the tool but in a different way, because what was acceptable when you only had to deal with North America Comp & Ben policies no longer holds true when you become part of a new global design. And even if none of your subsidiaries are using Workday at the outset, which probably from an implementation makes it easier, half way through implementation you may acquire a major company which is already live on Workday with their own compensation approach and suddenly the painfully reached agreements with the other business lines and countries is thrown up in the air. Although this may affect any implementation of an HR system, when it comes to compensation people tend to be very touchy and jittery about change.

One of the criteria to take into account is whether/to what an extent you want to make use of Workday payroll. Unlike other compensation products (or other modules from other product families), you usually license Workday Payroll for the countries you're interested in...if those countries are available. Unlike its predecessor product, PeopleSoft, where I was Product Manager in the early 2000s and where in a period of 18 months we added payrolls for 10 countries, Workday's payroll approach has been of the drip-feeding variety. For its first decade, the vendor only focused on its North American turf and released US Payroll and Canadian Payroll. Only recently have UK and French Payroll been released with Australia even more recently. Unless you're particularly lucky to be operating in only these countries, you'll have to make do with your current vendors for non-covered countries. But if you can implement Workday Payroll along with your Core Compensation from the same system, then you'll benefit from the advantages of having a single integrated system (same data model, security, reporting etc.)

And just because a country payroll is available doesn't mean it makes sense for you. Again, another differentiator with PeopleSoft (a.k.a. Workday 1.0): In France, for instance, the first PeopleSoft French Payroll customers were major companies (such as banking giant Société Générale); for Workday, large French companies which have taken to Workday HCM enthusiastically, have been strangely reluctant to test the payroll waters. So far, only mid-size companies like well-known retailer Franprix have adopted Workday Payroll whose implementation in France has been, shall we say, challenging. And I'm being charitable here.

Finally, if you wonder what Workday Payroll UN agencies use, be apprised that they are the only customers who don't need a country payroll to implement payroll because as an intergovernmental organization they are not subject to local rules and regulations. To put in another way, they make their own labor laws meaning that they can implement Workday Compensation/Payroll/Benefits in a very tight manner to meet their quite complex requirements (UN member states' rule creativity is on a par with national governments' legislative innovation - if you get my drift 😊)

III. WORKDAY ADVANCED COMPENSATION

Disclosure: This is my favorite of all 4 Workday compensation products - half of my decade-long Workday experience has been spent implementing it and providing support on it when it goes live. Unlike Talent/Performance, which can be implemented with a limited Core HR (not something recommended by Workday, although one of my first clients infamously did just that as they moved from SAP to Workday); Advanced Compensation not only requires that you already have in place a robust Core Compensation but also Core HR - without them, the exercise is largely pointless.

So, what is Advanced Compensation about? It is about organizing a structured conversation between various stakeholders at the beginning of a new year to make decisions as to who should be rewarded for their work through a salary increase, promotion, stock or bonus awards. Both Core Compensation and Advanced Compensation (henceforward CC & AC) are based on compensation plans (AC plans are Merit, Bonus and Stock plans) but here the similarities end.

If you see in an employee's file that they have been assigned a Salary plan or an Allowance plan (both CC) it means that the amounts at hand are guaranteed to be collected by the employee; however seeing that an employee was assigned a Stock plan or a Bonus plan (both AC plans) doesn't mean at all that they will receive company shares or a bonus. For that to happen, two more developments need to take place:

-First, a specific process (called a Compensation Review) needs to be launched. Until and unless such a review cycle has been launched, those Merit, Bonus & Stock plans in the employee's file (Worker Profile in Workdayese) are merely decorative. Just because you have a 5% target in your merit plan doesn't mean that you will be inevitably get a salary increase the following year. After a review cycle has been launched, another development needs to take place.

-Second, through various stakeholders (usually managers, HR, Comp & Ben team) agreeing on it, a decision is made and confirmed that your salary will be increased with, maybe, a few company shares and lump sum thrown in as well if you have been deemed worthy of the attention.

Where it all happens: The Compensation Review Grid

Please note that I mentioned earlier that AC needs two other modules to have been implemented: Core HR and CC. A third product, Talent/Performance, is not necessary but an increasing number of companies have found it useful to link AC to Talent & Performance so that a compensation review process follows a performance review cycle and feeds it through an automation of the proposed guidelines. Thus, if an employee has achieved 100% of their objectives they get, say, a 3% salary increase, but if they exceed their objectives then the increase goes up to 4%. Other criteria may also be included such as equity or market position, but as you may suspect I could rant for hours on the AC module and I still won't have enough time and space to do justice to it. I therefore better stop here and move to the last piece in the Workday Compensation puzzle.

IV. WORKDAY BENEFITS

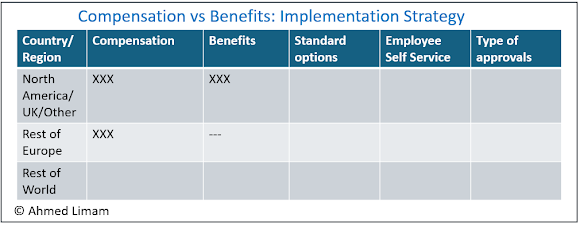

Just as any HRIS implementation will require an analysis and decision of what should stay in local payroll/HR systems and what should migrate to Workday/Compensation, the same thing applies to Compensation vs Benefits. Since practice, culture and regulations vary from region to region or even with a group of countries, any strategy will be different.

For instance, in the United States, Health, Retirement, Life and Disability can be provided to employees on a flexible basis, via an overall package whereby they pick what combination they are interested in. In continental Europe, on the other hand, most of these benefits are mandated by law and/or company/union agreements. This means that for US/UK employees, you may need strong self service benefits features, whereas in Europe these are not needed.

Below are some criteria of an analysis framework that I developed for my clients when implementing Workday in order to decide what should be implemented for what features. As an example, a Dental Plan may need to be set up as part of the Benefits module in the US since coverage, eligibility and elections need to be tracked from employee to employee where they can differ. In Europe, on the other hand, all a company may want to track is that as part of your overall compensation package (Total Rewards in Workday jargon) employees are provided with a Dental Plan. If which case no need to use the Benefits module for that (which, remember, comes with a separate license): You can use some appropriate compensation plan to track the same type of data.

Since obviously any approach has to be tailored depending on the specific situation of any company, for further information please reach out to me directly.

V. INTERFACE

Since most of what happens within CC and AC is irrelevant if it doesn't find itself paid to the employee, getting the data from Workday CC & AC is therefore key. This can be done in several ways.

-The basic way is to extract data via a report and, after having transformed it in the right format, feed it into the local payroll being used.

-Use the various Cloud Connect/Payroll Interface tools using specific protocols like PECI or PICOF that Workday offers. EIB (mentioned earlier) can be used as well (see below diagram.)

-You may also want to interface Workday Benefits to the various third-party vendors a company uses -> Cloud Connect for Benefits is probably your best friend especially for Cobra integrations int he United States.

Since this post is only about the four Compensation pillars within Workday, and Interface/ Integration warrants a separate post, I'll leave it at that for the time being.

(The blogger/consultant, after having spent most of 2023 implementing Advanced Compensation, is now providing operational support on a compensation review cycle launched this month for a global group with a 70,000+ headcount.)